The giants want you poor. Here's how you can fight back and build wealth.

The wealth narrative is about to change and it's going to be an incredible ride.

It is far more disastrous for a society to give rise to a people who have the means to obtain wealth but choose to reject it, then it is for a society to give rise to a people who can never possess such means to begin with.

It took most of my life to learn this hard lesson. As a child I didn't understand the concept of wealth and when I entered into adulthood I had developed —thanks to the world around me— a disillusioned idea of what it meant to be wealthy. I had learned that wealth was defined by one's ability to live in excess materialism. This concept was and still is often packaged with negative connotations such as greed, power and envy. But I also wrestled with the juxtaposition to these ideas that filled my head which held a more "humbled" perspective —the belief that one could be wealthy in mind or spirit while being physically poor. For most of my adult life I struggled with trying to reconcile it all. As someone that grew up in the Christian faith, Bible verses that spoke to the love of money being the root of all evil or exposed rich rulers for their greed weren't foreign to me. I certainly understand the messaging but it didn't really remove the tension. Especially considering the Bible uses "kingdom" language throughout its entirety.

I believe the unbalanced nature of how wealth is typically portrayed in our culture is problematic. The overly negative and self-centered representations concerning wealth, along with financial illiteracy led to my early development of an unhealthy relationship with money. Sadly, this unhealthy relationship took me completely off the board as an essential asset needed for the embetterment of the human race. I know that sounds a bit melodramatic but just stay with me. It will all make sense in the end. This is where many, many people are today —simply sitting on the sidelines, manipulated like cogs in the wheel of the machine that is the master of their lives.

I'd argue that most adults today —particularly in America— have the wrong idea about wealth in general because of the indoctrination that starts at young age. I believe the miseducation of wealth is part of the larger indoctrination play regarding the manipulation of humanity by the powers —or giants— that be. From our youth we're all groomed like clay, molded into what will be little workers for the industries of our time. All of us, whipped into shape by our taskmasters starting at the very moment we're thrust into the education system. Our goal —as we're taught— is to complete the necessary tasks presented before us as our minds are slowly transformed into what the machine needs us to be in order to keep it alive. With that singular thought in mind, actual critical thinking becomes foregone. We all met this reality the moment we realized that what we were learning at the time had zero application in the near future. But we keep completing the tasks, checking the boxes and taking the tests all while knowing deep down the math wasn't adding up.

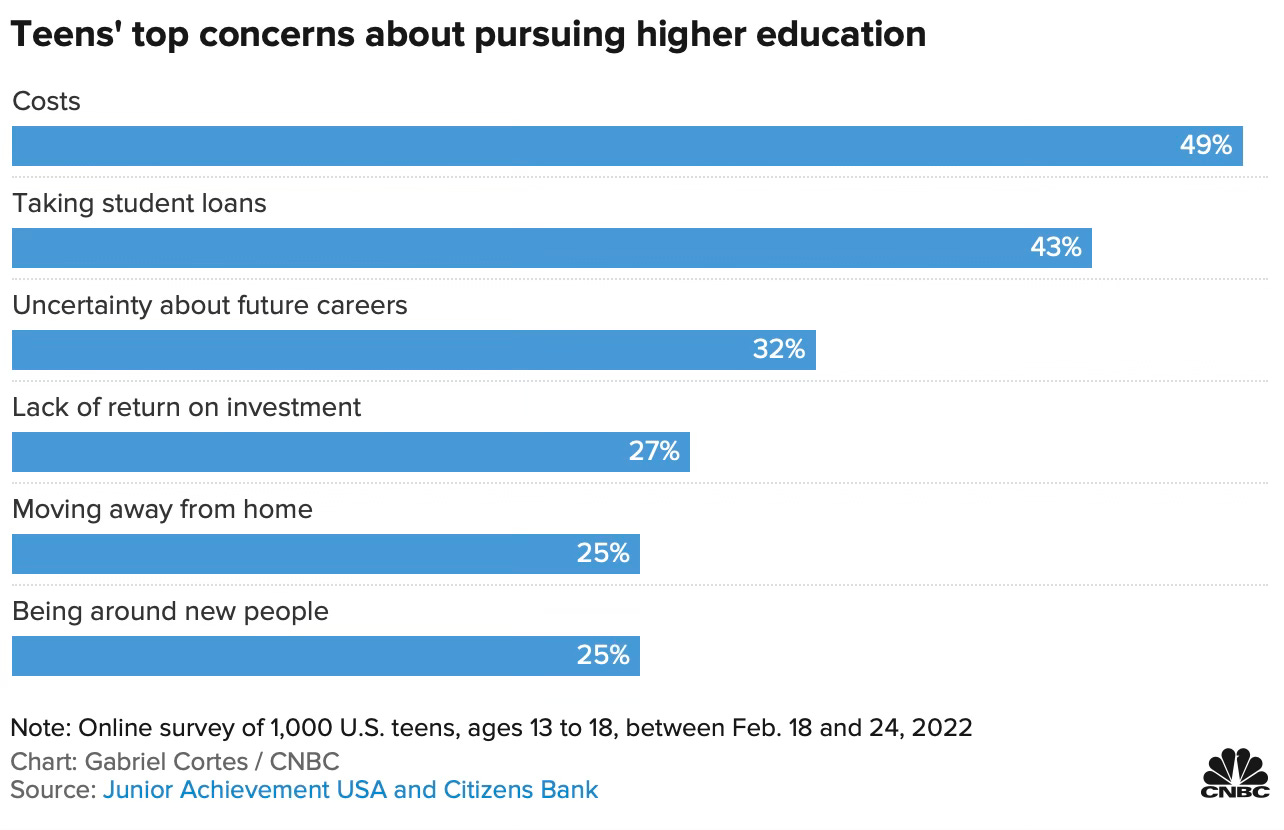

In a 2022 survey taken by 1000 U.S. teens, 54% felt unprepared to finance their futures. Another survey found that found that 93% of teens believe financial knowledge and skills are necessary in order to achieve their life goals, yet scoring an average 64% on the National Financial Literacy Test.

Interestingly, despite the fact Americans —to the tune of 84%— overwhelming agree that high school students should be taught financial literacy, it still isn't being done. At least not to the degree that concerns such as global warming or gender identity is being taught.

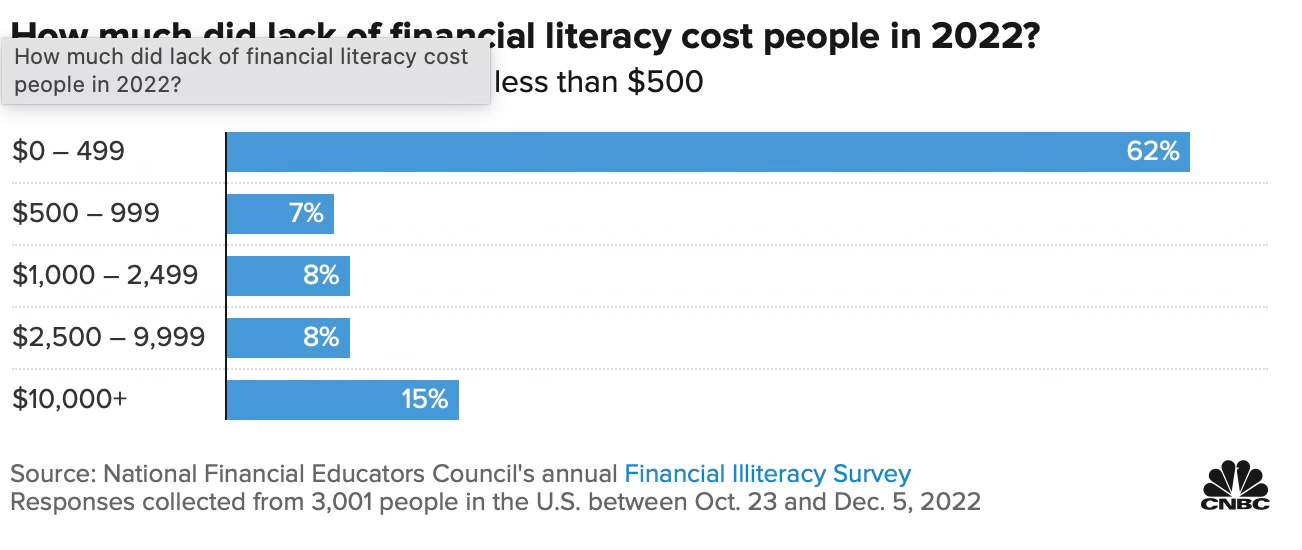

This issue can become increasingly complicated as one enters into early adulthood, often without a clue as to where their life should go. Despite living on the planet for nearly two decades many people hit a wall, often choosing to hide for a few years in college, hoping they'll magically discover their calling and life will sort itself out. But there's a cost to being financially illiterate. A lack of financial literacy cost 15% of adults at least $10,000 in 2022.

“A lot of people come out of [school] without having been taught financial literacy in any detail,” said certified financial planner Denis Poljak, a partner with the Poljak Group Wealth Management at Steward Partners in Shreveport, Louisiana.

There's a real cost to not understanding how money works outside of using it as a means of value exchange. At best most young adults are only taught the very basics concerning money such as how to earn it, count it, spend it, save it and incur debt through instruments such as credit cards or loans. Soon —as young adult life begins to unfold— there's a recognition of just how impossible it is to keep up with the ever increasing expenses of the world. Many start to realize they're now in unimaginable debt just as their lives as independent members of society is getting started. How did they get to this place? Weren't they educated? Isn't that the point of the rigorous "schooling" we all receive for nearly two decades with a shiny graduation certificate to show? To be educated? No. The truth is none of us were truly educated. Instead, we were all indoctrinated for the purposes of becoming a functioning member of society to the degree in which the system demands to keep it running.

In our modern world, our entire lives are shaped in such a way that causes us to lose our malleability so that we will serve out only one purpose. That purpose is to keep the machine —the system that manipulates humanity— going in a certain direction. The machine —and subsequently the giants— don't need freethinkers and risk takers. And it certainly doesn't need members of society attempting to obtain sovereignty over their lives and wealth. Allowing this to happen jeopardizes the very foundation that modern day society rests upon.

Convincing people that wealth or being wealthy is somehow bad is part of the propaganda needed to control a society. For example, we're all made to think in terms of equal distribution regardless of the amount of economic energy one contributes to a society. Capitalism is proclaimed by its critics to be a bad thing merely due to the existence of struggling lower class members within a capitalistic society —thereby deeming private entities as evil, greedy cash hoarders that exploit "workers".

Certain religious ideologies also take root in the mind to convince us that being poor equates to being meek and humble —somehow elevating one's moral character over those who are rich which again equates to evil and greed. The lie is that poverty is somehow tied to altruism and the desire for wealth somehow comes at a detriment to your fellow man, negatively impacting greater society. We view those such as the Messiah as only poor —looking through the lens of philanthropy— forgetting He is also rich as He literally owns everything in existence, ruling His own kingdom.

I want you to realize there are no bounds to the level of sinister-ism that's at play concerning keeping the majority of humans across the globe malnourished physically as well as financially. This creates an unnecessary dependency on the ruling powers that be. Many people are not only financially illiterate they also don't understand basic economics. That's why when we see studies released by firms such as Pew Research Center around this topic, the concept of wealth becomes increasingly more difficult to understand.

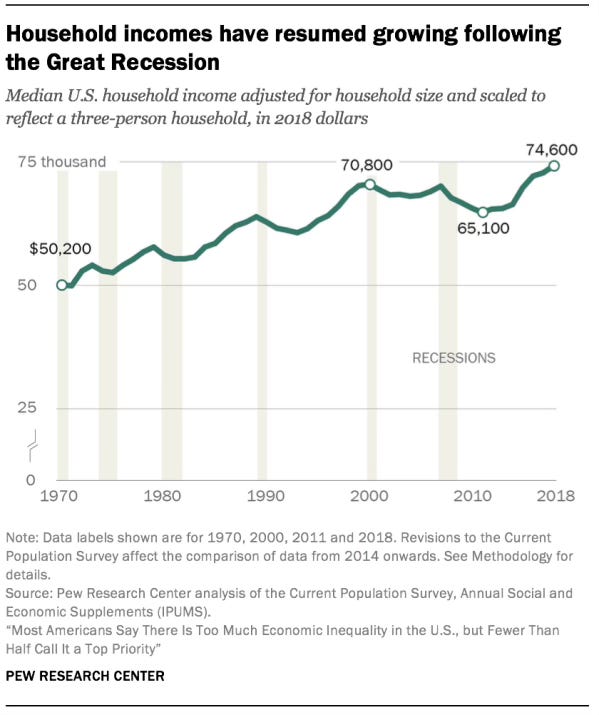

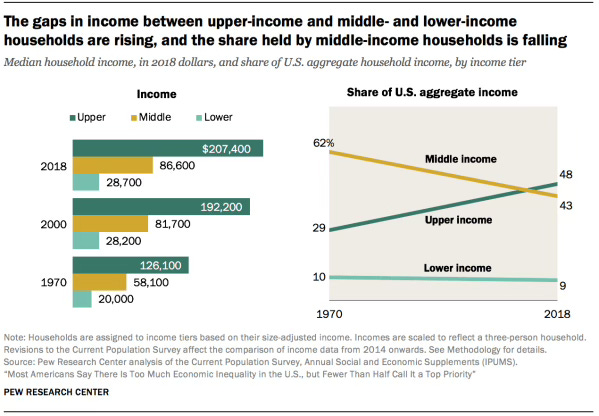

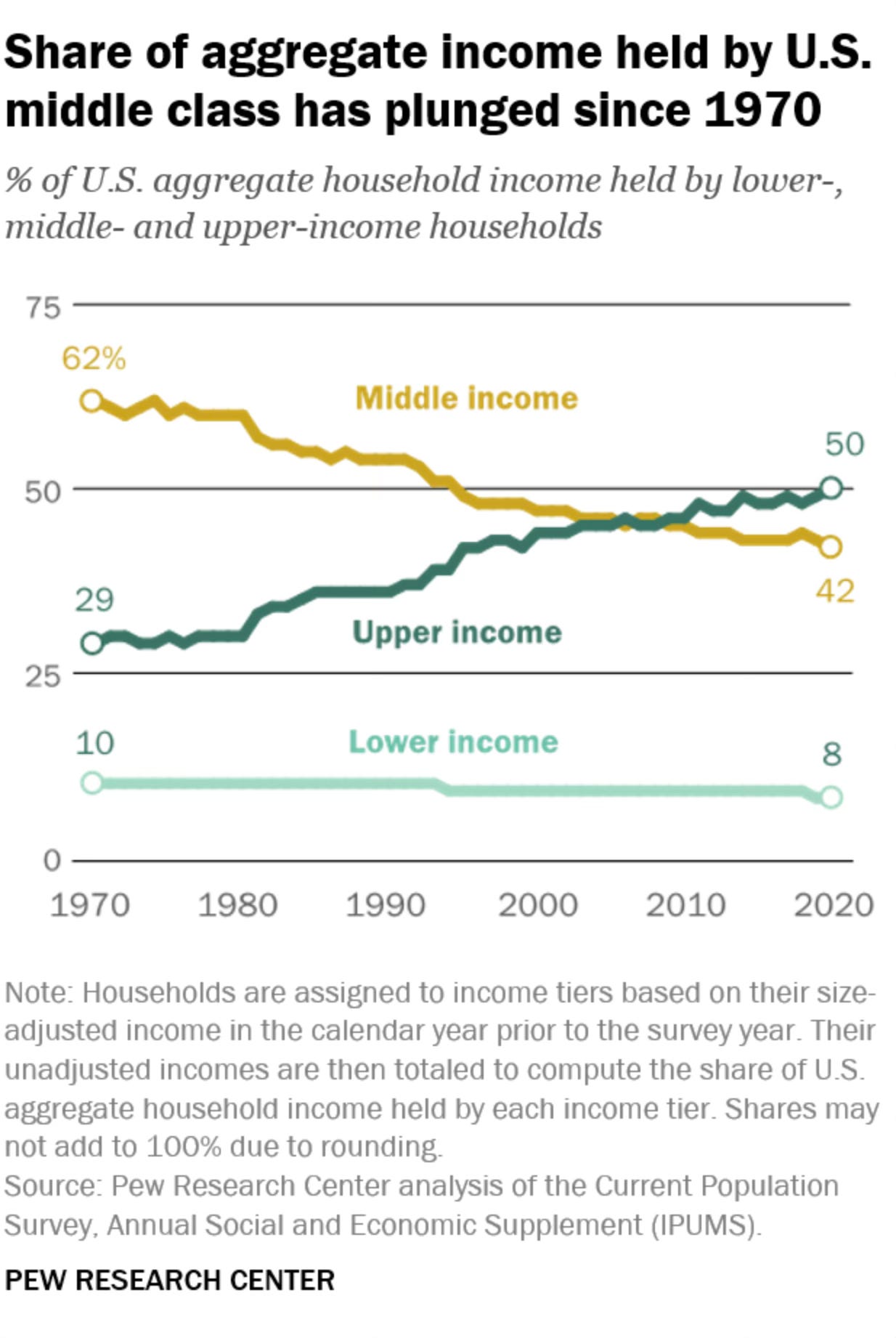

Back in 2020 it was reported that household incomes have resumed growing following the Great Recession.

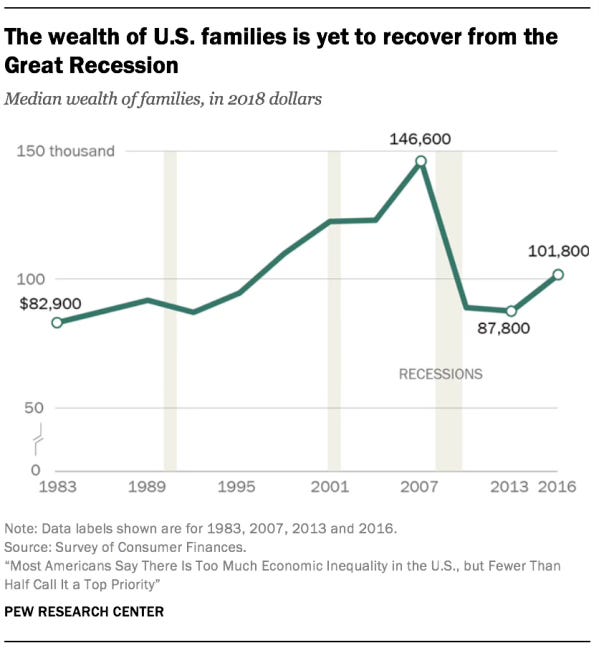

On its face, this looks fine and dandy. But at the same time it was reported that the wealth of American families is currently no higher than its level two decades ago. How can that be?

To make matters worse —and even more confusing— the income gap between the upper and middle class is growing exponentially while the middle class income is falling to close the gap with the lower class.

To top it off, there's no shortage of media blasts attempting to convince everyone that the current U.S. economy is strong despite what the American people are reporting:

“Overall, it's been doing really well. The GDP has been growing. We didn't have the recession that a lot of us have been anticipating,” says Selcuk Eren, a senior economist at The Conference Board, a research group. “Unemployment has been under 4% for, I believe, 23 months in a row now. That is the new record.”

Despite those robust numbers, most Americans, 68%, say the economy is worsening, according to a December 2023 Gallup poll, which showed that four in five U.S. adults rate the country’s current economic conditions as “poor” (45%) or “fair” (33%). Only 19% of people polled said the economy is “good,” in keeping with the positive economic markers.

This is all simply more of the same old psyop to get American citizens to ignore reality so they will believe the narrative "Big Brother" is spewing. What the mainstream media often fails to double down on is precisely how Americans are carrying the economy on their broken backs which give the illusion that everything is fine.

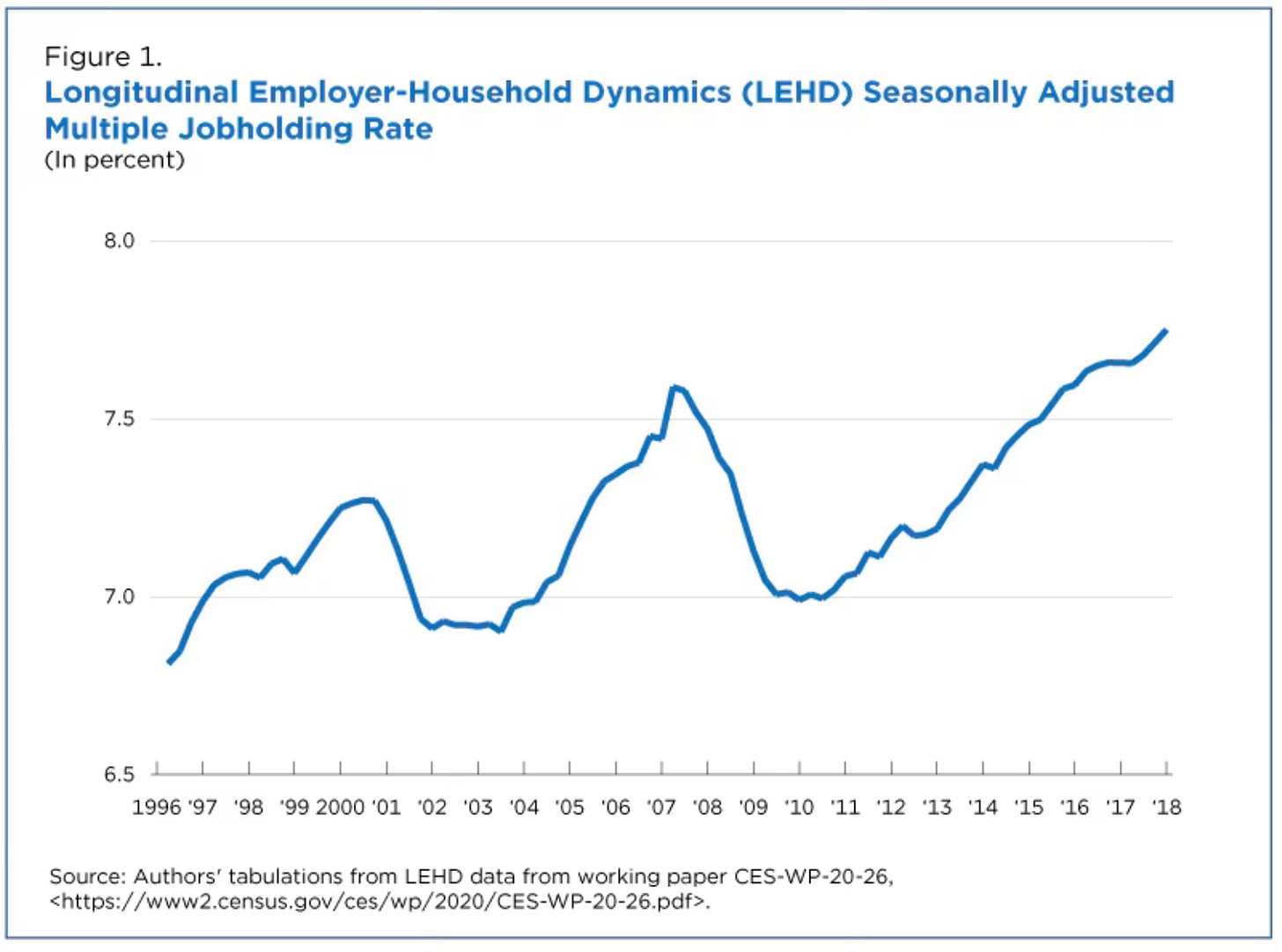

According to the United States Census Bureau, there's been an upward trend of Americans working multiple jobs over the last couple of decades. The end of last year saw the highest level of Americans working multiple jobs since the start of the pandemic. And as we've moved into 2024, it appears this trend isn’t slowing down —8.7 Million Americans Now Work Two Jobs To Make Ends Meet Despite Inflation Continuing To Cool.

This number is the highest since pre pandemic and is growing by hundreds of thousands per month. In October, the number was just under 8.4 million jobs. 1

People are working multiple jobs to make ends meet which makes the jobs report look great.

Spending is also up which bolsters this nonsense that the economy is strong. Increased consumer spending makes sense considering you need more dollars to pay for the same things due to inflation. This has created credit card debt to the tune of a record breaking $1.13 trillion. So yes, jobs are up, unemployment is low and spending has increased. On paper the economy looks good. But looks can be and are deceiving in this particular case. This is why the majority of Americans disagree with the “strong economy” narrative. This is all too Orwellian. We're slowly being indoctrinated to assume a poverty mindset, thereby developing a dependency on the ruling class to save us.

What I've just laid out for you, is the why behind it all —manipulation and control. But I haven't laid out the how. Once you begin to understand the how, you can actually fight back.

The how

The truth is that the U.S. dollar has been losing its value for several decades. In fact, since 1971 the dollar has lost 98% of it's purchasing power thanks to the continued "printing" of the U.S. dollar which inflates the currency. This is coupled with the fact the dollar is no longer backed by a physical commodity like it used to be before the gold standard came to an end. The dollar is now effectively backed by the government. The same government that issues our currency also debases it through the injection of more dollars into circulation when it can't generate enough revenue through taxation or debt to pay for its pet projects or concerns like wars. This debasement is why it's becoming increasingly more difficult to financially get ahead. The dollar is simply worth less each year.

But backing the dollar with a physical commodity such as gold isn't a perfect solution either. The problem with gold is that it's only divisible to a certain degree, it's heavy and not easy to carry, and it comes with the illusion of scarcity —meaning more gold can simply be mined and put into circulation if more is needed which would debase its value. This is a problem that has always existed for humanity once we started using different items to exchange value.

What this all means is that inflation is the real enemy and the systems put in place to enable us all to use money as a means for exchanging value is broken. This isn't a new concern. The problem with inflation has been around since humans have used sea shells or stone discs as a means for value exchange. This isn't a U.S. only problem either. While currently the inflation rate in the United States is sitting around 3.1% —with many arguing it is much higher— there are countries in a far worse predicament such as Argentina with a whopping 254% inflation rate.

I've come to learn that most people aren't aware that money is broken, but they do realize their dollars are no longer stretching as far as they did in the past. Everything is becoming more expensive and this has been the case for many decades. So what do most people do to counteract this problem? They attempt to work harder, work more hours, obtain a second or even third job, or attempt to save their way to wealth, not realizing that every year their dollars —which get taxed several times— are slowly being debased. This leaves a society in the vicarious position of trying to earn more of something that is constantly losing its value, to pay for things which appear to be constantly increasing in price. And the only people that benefit from broken money are those who are in charge of the broken monetary system and can issue more broken money —players such as the government and central banks. When there's a need, new money can simply be injected into circulation in conjunction with increasing the federal interest rate to pay for debt or bailouts, but this adds downward financial pressure on society. Everything becomes more expensive for everyday members of society as well as businesses and unfortunately there are no bailouts for either.

The truth is the current monetary system is rigged to take advantage of you in order to keep it alive. The system is a soul sucking monster that survives on the blood, sweat and tears —which can be thought of as energy— of the people that participate in the monetary system. It falsely promises prosperity and wealth for those willing to dive deep enough into debt in order to obtain prosperity and wealth. That debt is a net result of excess human energy expenditure —working multiple jobs, buying low-quality cheap food, taking out loans and increased credit card utilization which amounts to sacrificing mind, body and health. This leaves the citizens of a nation hoping to still be alive in their later years with enough vigor to enjoy whatever prosperity and wealth they've managed to cobble together, if any. However, with the ever decreasing quality of life due to the manufactured global health crisis, this becomes near impossible. The so called "prime years" are siphoned off for maximal energy to feed the system. Every year countless people make the decision to "retire" and enjoy the stored up fruits of their labor only to die shortly after —often due to declining health, never enjoying any of it. But the system got what it needed. I personally have watched this happen multiple times to deceased friends of mine.

I truly believe humans weren't meant to live this way. Yet here we are. Over the last few years I've realized that the way I've thought about money and wealth in general was completely wrong due to a lifetime of indoctrination. As I've mentioned several times before in my earlier work, humans have a responsibility bestowed upon us by Yahweh to steward this domain called Earth. The goal is to propagate His kingdom, effectuating change for good wherever we can as image bearers. But I've learned that this is a near impossible task if God's image bearers are all poor, manipulated cogs in a wheel. Without wealth it's incredibly difficult to become a necessary change agent in the world because survival of mind and body will demand priority. And if you steward a family then that goal becomes exponentially more difficult under such a weighty responsibility.

In this world, there are many good and bad actors. I believe we need many more good actors who are willing to seek out ways to obtain wealth to better the human race. I believe there are a lot of people who desire to do good but don't have the means or knowledge to effectuate such improvements. In order to change this, we have to alter the way we think about money and wealth, first learning what it is and how it works as individuals, families, and as a society. We then need to change our view from one of cynicism and false humility in regards to wealth to embracing the possibilities of what wealth can do in the hands of image bearers. This is how we fight back against the giants that control us all.

A solution

Obtaining wealth and prosperity is often easier said than done but one innovative solution does exist —Bitcoin. It's a known fact that most people throughout the world don't understand what it is although thankfully this is slowly changing. I would encourage the reading of the Bitcoin whitepaper to learn about its origin and the problem it is solving. Humanity has always been in need of a commodity that could solve the issue of inflation and democratize wealth based on the value each member of society provides. Bitcoin is that solution. To understand it is to break the wealth indoctrination cycle.

I started my tech career in 1999 and I remember when Bitcoin was launched in 2009. Like many of us tech geeks, I thought it was interesting and a great utopic idea, but I didn't pay it much attention. I followed it while sitting on the sidelines over the years. It wasn't until 2020 that I started to seriously look into it and in 2021 I made the decision to participate in the revolution by purchasing Bitcoin.

Over the last few years I've watched mainstream media, power hungry politicians, scared bank executives and clueless financial analyst attempt to dissuade the general public from participating in Bitcoin —calling it a scam, a get rich quick scheme, and a vehicle for money laundering along with other ridiculous claims. This was all while refusing to be transparent and honest about the failures of the dollar and our corrupt monetary system —hello Great Recession of 2008. The irony of disparaging Bitcoin as an instrument to facilitate corruption when JPMorgan alone has paid over $38bil in fines imposed by U.S. regulators to date is almost incomprehensible.

But then I started to notice something really peculiar. Those who were publicly discouraging participation in Bitcoin were entering the game in private. One of Bitcoin's biggest critics is Jamie Dimon of JPMorgan. Yet in 2021 I was surprised to see this CNBC headline, “JPMorgan, led by bitcoin skeptic Jamie Dimon, quietly unveils access to a half-dozen crypto funds”:

On Thursday, financial advisors were allowed to begin placing private bank clients into a new bitcoin fund created with crypto firm NYDIG, according to people with knowledge of the move.

The sources declined to be identified speaking about the offerings, each citing an awkward fact: JPMorgan CEO Jamie Dimon has been one of Wall Street’s most outspoken skeptics of bitcoin and related digital assets.

Well this is odd? I thought Bitcoin equals bad, Bitcoin equals crooks, Bitcoin equals pyramid scheme. What's going on?

But there's more. Around the same time Forbes released an article naming Bank of America as one of the 'Heavy Hitters' that were investing in a Blockchain fund. The New York Times released in article in 2021, “Banks Tried to Kill Crypto and Failed. Now They’re Embracing It (Slowly).” Well would you look at that? Interesting.

But it wasn't just the big banks that were trying to get in on the action while convincing the "cogs in the wheel" to stay away from this very unsafe and highly volatile scam. Even the U.S. government was amassing a secret stash —collecting it from its supposed cybercrime unit but then auctioning it off. Another CNBC headline from 2021; The U.S. government has a massive, secret stockpile of bitcoin — Here’s what happens to it.

Fast forward a few years and then there's Larry Fink, the CEO of the world largest financial asset management firm, BlackRock. Once a very vocal critic of Bitcoin —calling it an 'index of money laundering'—, now turned "savior" of Bitcoin according to Bloomberg. How the tides have turned.

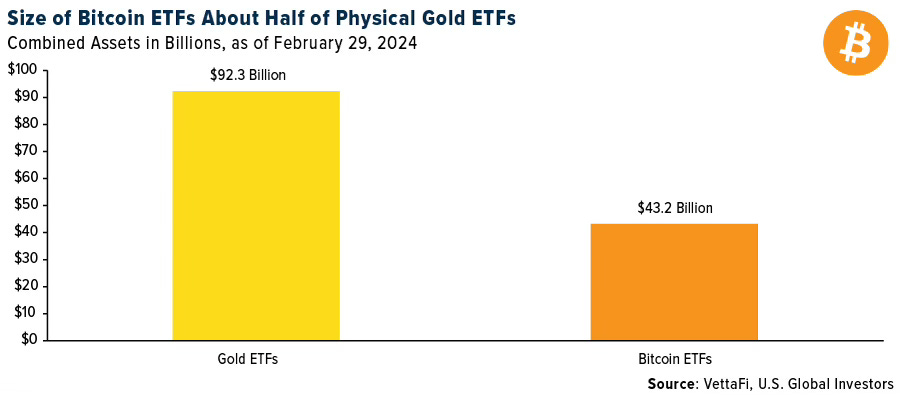

Early 2024 saw the SEC approval of Bitcoin ETFs, which afterwards 12 of them launched. BlackRock's iShares Bitcoin Trust dominates the Bitcoin ETF market followed by Fidelity. In fact their bitcoin ETF hit $10bn assets under management (AUM) on 1 March, the fastest ETF to ever accomplish this feat.2 For reference, it took gold ETFs 2 years to reach this milestone. In fact, the Bitcoin ETF —which provides Bitcoin exposure to those who do not want to self custody the asset— is the most successful ETF launch in history.

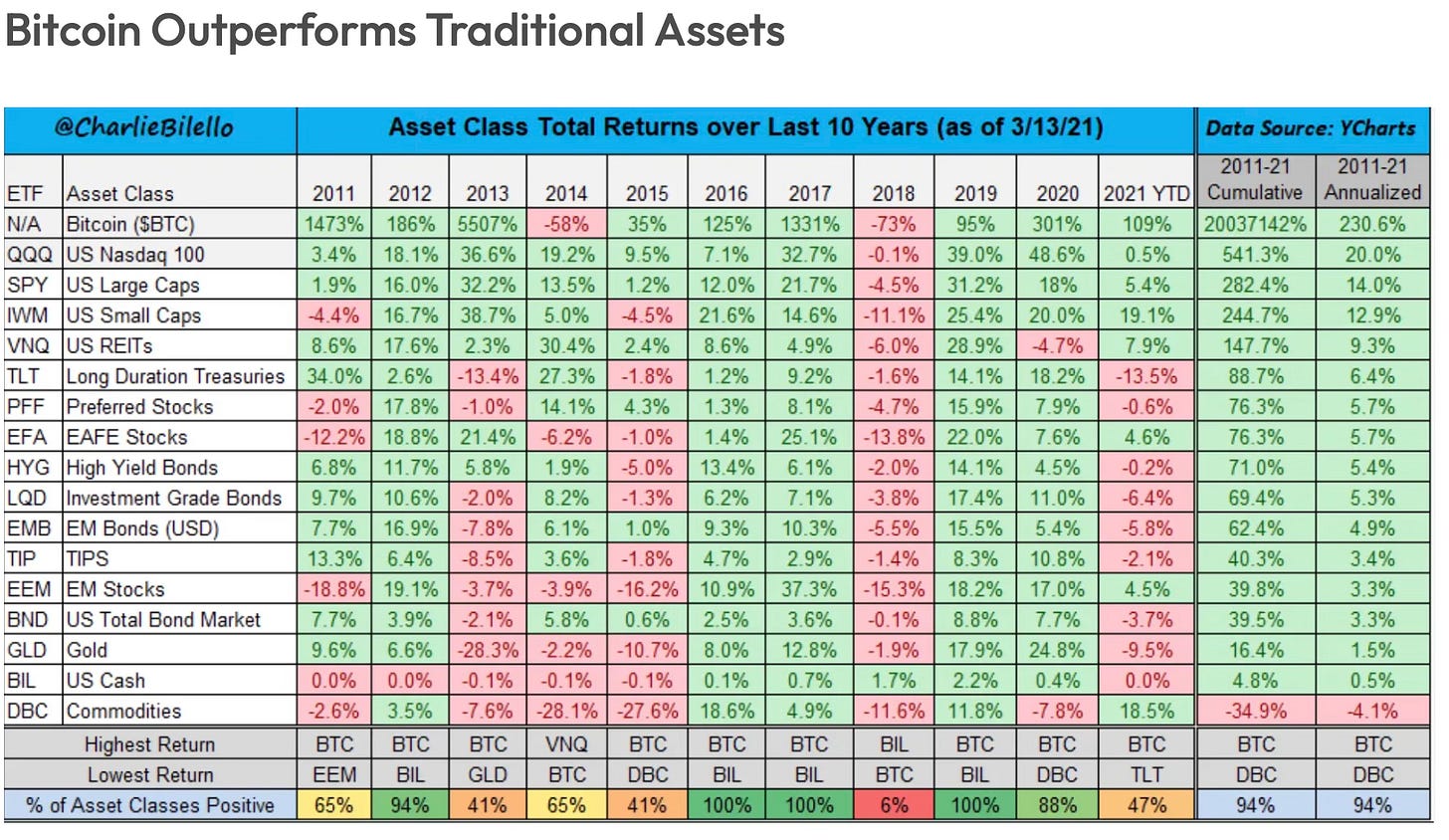

Just incase you still might think there isn't much interest in Bitcoin, know that the Bitcoin ETFs are already near half the size of gold ETFs in less than 2 months. If you look at Bitcoin alone it has massively outperformed every traditional asset class over the last decade. Big money has taken notice. And they took notice while telling everyone else to look the other way so they could get in early.

Bitcoin's performance makes sense once you understand its intrinsic value and yes it has intrinsic value. The major mental struggle people have with understanding Bitcoin's value is realizing that money is only a "means" for value exchange. Money is not a tangible asset nor has it ever been. It is an idea based on faith and agreement. We all agree and believe in the means used to exchange value between us. This is evident by the fact that we now live in a cashless society. Physical items were simply the best way to represent this idea before the advent of the digital age. Thanks to the digital age, Bitcoin is the best hard asset that has ever been created in the history of humanity. The problem of inflation and continued dollar debasement needed a digital asset as a solution —something modern technology now affords.

Bitcoin is the supreme store of value and is best thought of as "digital gold". It's what we desire gold to do while gold —like every other commodity— falls short. It provides true scarcity with only 21 million to ever be created or "mined". It is far more divisible than fiat currency or an asset like gold with one Bitcoin being divided up to 8 decimal places. There's plenty of these units —called satoshis— for everyone on the planet.

Bitcoin can be used as a digital currency and means of value exchange anywhere in the world at any time without foreign transactions fees or the use of a mediator such as a bank which determines when it could be sent, much like fiat. If I want to send money —Bitcoin— to someone in Zimbabwe at midnight, I could do that through the incredibly secured Bitcoin network almost instantly without the permission of any financial institution or the need to worry about a currency exchange.

Unlike fiat, every single transaction that takes place on the Bitcoin network is stored in a ledger that can be read by anyone. This is why it is much easier to find criminals who commit fraud on the network. A very difficult task to complete when dealing with fiat or any other commodity. If someone hands me a dollar out of their wallet, or if I steal their entire wallet so I can gain access to their credit cards, there is no record of either "transaction" ever taking place. This is not the case with Bitcoin.

There was a time when members of a society possessed sovereignty over their wealth. That is not true today. We've all traded away our sovereignty for convenience —tossing our money into banks. Governments, courts, and even banks can lock us out of our own money and seize our assets. Just see the story of Kanye West and Adidas. No one should be able to freeze bank accounts or seize assets at will. If a bank or government entity can seize your wealth outside of evidence that it is first stolen that means it never belonged to you in the first place. This is precisely why the rich attempt to hide as much of their wealth as possible in order to preserve it. They're acutely aware it can be seized on a moments notice. However, we've all been indoctrinated that true sovereignty is a bad thing so most people look down on such practices. Most assume if wealth is being hidden then there must be bad actors at play. Yes, they're called governments and banks.

The issue of sovereignty becomes more complicated if someone decides they want to pack up and move to another city, state or even country. It's difficult and costly to move a commodity such as gold, plus it needs to be stored somewhere secure and at a cost. Bitcoin is permissionless. There's no CEO of Bitcoin or gatekeeper. You can do what you want with your Bitcoin when you want to with whoever you want to do it with. Your Bitcoin follows you around the world.

Other instruments used as a store of value have their own inherent problems. For example, real-estate is solely dependent on how the overall housing market is performing. All it takes is a war or a pandemic to quickly lose your investment and this doesn't even take into account any taxes or property management fees —you can't really take an investment property with you if you move.

An investment in stocks can turn south the moment the economy is in a downtrend or if a company you've invested in suddenly goes through turmoil. The usual hedge against such risks is to put money in something "safer" like an index fund so you don't have to deal with picking the right individual stock while you pretend to play hedge fund manager. The S&P 500 is the "go-to". But the index is heavily influenced by a handful of companies known as the "Magnificent Seven" —Apple, Alphabet, Microsoft, Amazon, Meta, Tesla and Nvidia. In 2023 these 7 stocks alone racked up a 111% return vs the broader S&P 500 market which netted a return of 24%. These seven tech companies dictate where the S&P 500 goes.

How about the idea of “savings accounts” which don't even net a return equal to current inflation rates? This is a poor place to attempt to preserve wealth. Money in a savings account is simply money losing value, yet it makes the banks money because they can loan it out with much higher interest rates.

This is why diversification is such a theme in our day —because money is broken and we've all been taught to use different instruments in an attempt to try and store value while mitigating risk in order to build wealth, despite the inherent problems with each instrument. Each one acts like a sieve with some sieves containing larger holes than others allowing more money to flow out the bottom which means less for you.

While years ago Bitcoin was thought of as a way to quickly get rich due to its insane volatility, a more proper way to think about Bitcoin is it's a way to prevent going poor slowly. It is a true store of value which will continue to increase as fiat around the world continues to lose value. The reality is things aren't becoming more expensive. The dollar is simply losing its purchasing power. Greedy corporations aren't the enemy. That's part of the lie. The reason why large financial institutions and countries around the world who've adopted Bitcoin as a legal tender have decided to participate is because they've started to recognize Bitcoin is the solution to broken money.

What I hope you take away from this article, is a new found desire to participate in the game of wealth so you and your family can be part of the change necessary to steward the world in a better direction. If we all sit on the sidelines and let the giants accumulate wealth while they keep everyone else out of the game, that doesn't bode well for humanity. We're living in a pivotal point within human history where wealth can finally be decentralized which means a massive wealth transference is currently taking place. We're still at the very beginning of this shift but it is moving quickly thanks to the injection of institutional capital.

There are many more pros to Bitcoin and I never really touched on the technical aspects of how it works but this article is already lengthy. My hope is it provided enough value for you to become curious to do your own research and hopefully participate in the greatest wealth transfer in human history.

💛1BTC = 1 BTC 4EVR

Thank you for reading. Feel free to leave comments as I’d love to hear your thoughts.

I watched Bitcoin rise and stayed away because the elite said it was garbage. Jamie Dimon and his boys already have their wealth and don't want you getting yours. I have some ETH, but I wish I had more. Well written piece.